The saying hedging your bets is a pretty common phrase in everyday life, but when it comes to actual betting, it’s a term only experienced punters seem to have a grasp on.

It’s a popular strategy among seasoned gamblers in the know and is used in order to reduce the risk of your bet and increase your payout. Used correctly it can be an effective strategy. It is commonly used on betting exchange apps like Betfair and Betdaq.

What Is Hedging Your Bets?

Hedging bets is actually a pretty simple strategy in the fact that you’re betting on multiple outcomes to cover your bases. How this works is by placing a lay bet on top of your original bet to guarantee a profit, albeit a small one.

This is similar to arbitrage betting or laying off bet strategies.

To use hedging as a method you will place a back bet on one outcome and a lay bet on another. Usually, your second bet is insurance.

Hedging Bets Example

We find hedging works best on longer-term markets, we will cover in-play hedging below.

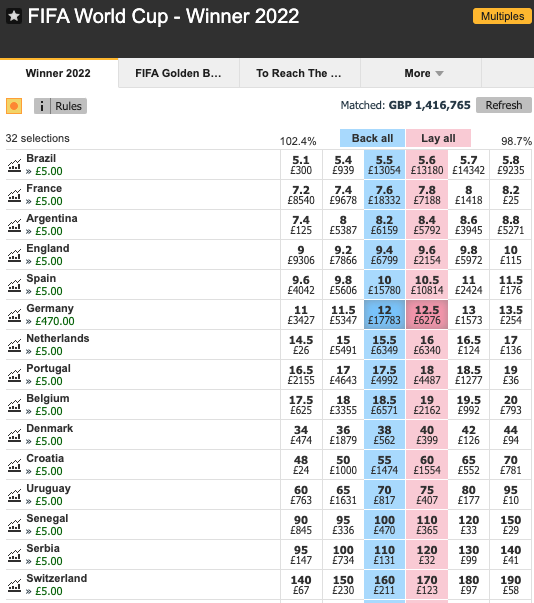

Let’s say we’re betting on the World Cup and 18m months before the event starts we think Germany will win it. They are currently at 12s on the exchange. We place a back bet of £100 for this example.

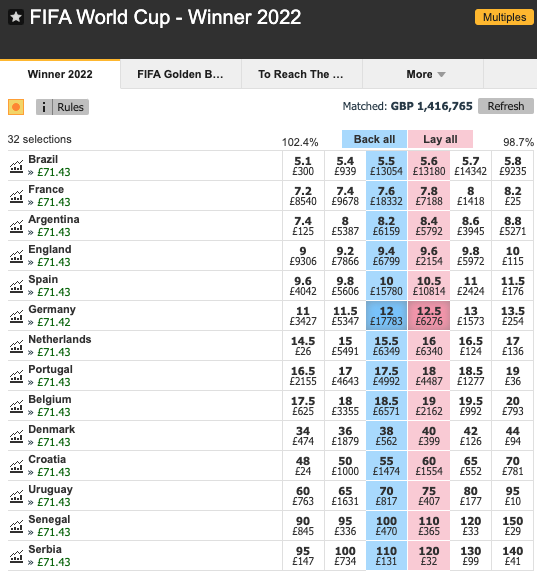

Here is an example of how the market would look*

By the time the World Cup starts Germany has been playing well and the odds are down to 7s of the win.

Here we can make 2 plays.

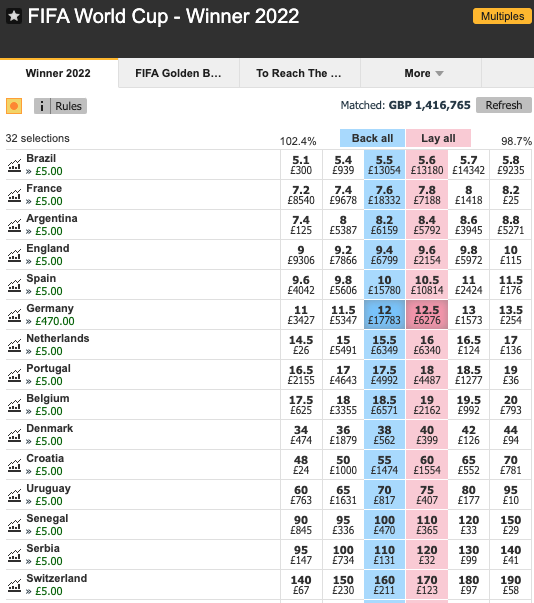

Cover the stake

Here we place a lay of £105 to cover the original bet. This leaves us with a profit before 5% commission of £5 if Germany does not win and a profit of £470 before commission if they do win. Here is how the market would look –

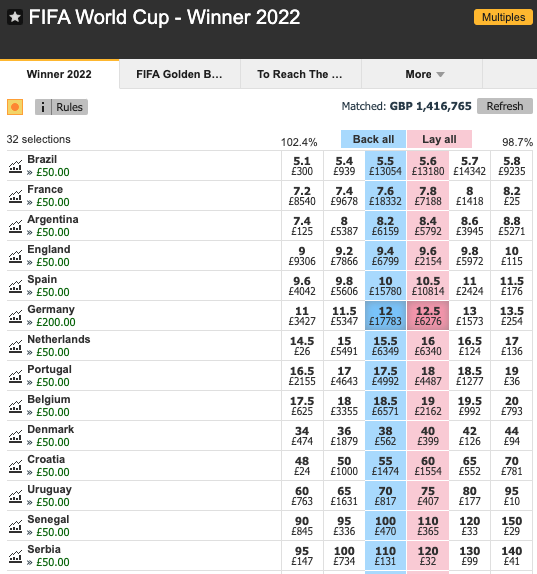

Or take insurance to secure a bigger profit if they don’t win and a smaller profit if they do. If we increase the lay on Germany to £150 then we get a £200 profit on any team winning and a £400 profit on Germany winning, as shown below –

The final option we have isn’t really what we’d class as a hedge – equalising the profit. Here we place a lay of £171.43 and secure a profit of £71.43 regardless of who wins! This is done using a back-to-lay calculator which calculates the exact stake you need to level the profits.

Where Can I Use A Hedging Strategy?

You can hedge your bets with any bookmaker around as ultimately it isn’t any form of special offer, but a tactic that uses regular betting odds. You can cross over bets, so if you placed your back on William Hill, for example, you can still lay it off on Betfair.

You can also use it on standard betting apps by placing another back bet g=agisnt your original bet. This is tricky with the example above on the World Cup. Let’s say Germany was in the final against Spain and you wanted the hedge that bet. You could place a back bet on Spain to win to hedge the Germany bet and secure a profit.

Can I Hedge Bets On Any Sport?

You can hedge your bets on any sport although it’s always best to do so on markets with only two outcomes. In football, this might mean betting on the To Win or Draw market in one instance, or to get through a round it a cup competition.

You can use it in any instance though and as many selections as you please, it just gets a little more complicated when calculating your profits.

The likes of tennis, NFL and boxing are always good for this particular strategy.

Below you’ll find a few examples of the sports in which you can hedge your bets:

- Football

- Cricket

- Rugby League

- Rugby Union

- Tennis

- Horse Racing

- Boxing

- NFL

- Basketball

- Baseball

- NHL

- Darts

We hope that has helped you to understand how to hedge your bets. If you have any questions please send us a Tweet to @bettingapps and we will do our best to answer any questions you have.